life insurance face amount issued

Death Benefit Option Change. The gross premium G for a fully discrete whole life insurance with face amount of 1000 issued to 40 is determined using the equivalence principle.

What To Do If You Can T Pay Your Life Insurance Bill Forbes Advisor

In 2020 the aggregate face amount of life insurance policy purchases amounted to 33 trillion US.

. I G 35797 ii 1000P40 29576 iii The excess of the net premium reserve over the gross premium reserve at time t1 is 9398 iv i 005 Expenses of Premium Per. The aggregate helps the insurance company. The face value or face amount of a life insurance policy is established when the policy is issued.

In a life insurance policy the amount payable in the event of death as stated on the front page of the policy. Statistics about Face Amounts. The average face value of an individual life insurance policy is 160000.

Face amount life insurance definition life insurance face amount meaning life insurance face value face amount of policy industrial life insurance face amounts what is face amount face amount meaning face amount vs cash value Groman took advantage over 75 cents a reduction plans by stretching their waiting for. Ten year term insurance for a person aged 55. The high premiums combined with a low face amount for the death benefit make guaranteed issue life insurance a less desirable option for relatively healthy individuals.

The effective date is the day a life insurance policy is considered to be active or in force If your policy lists January 1 2022 as the effective date it means that if you pass away on or after that date your insurer will pay the death benefit to your listed beneficiaries. Monthaversary Face decrease cannot exceed a minimum face amount of 250000. The amount of life insurance youre eligible for.

According to Statista the average Face Amount of Life insurance purchased in the United States in 2015 was about 160000. Since the amount of insurance protection provided under a given policy is usually stated on the face or first page of the contract the term is commonly used when referring to the death benefit in the contract. Individuals will be notified of the acceptanceissuance of their insurance policy by VA or the appropriate designated entity.

After October 1 2008 the maximum amount of credit life insurance could not exceed the amount and the duration of the indebtedness. Available for insured ages 0-60. The maximum term a credit life policy could be issued was for 10 years.

VMLI is issued in amounts up to 200000. I G 35797 ii 1000P40 29576 iii The excess of the net premium reserve over the gross premium reserve at time t1 is 9398 iv i 005 v Expenses of Premium Per. For instance final expense life insurance policies typically range from 2000 to 25000 as theyre designed to cover funeral burial and.

Average life insurance face amounts have come down from a. Some types of life insurance are capped at small amounts. All USGLI policies were declared paid-up as of January 1 1983 meaning that no further premium payments were due.

When this happens most policys endow and the policy owner receives the cash benefit. When a ten year renewable term life insurance policy issued at age 45 is renewed the premium rate will be the current rate for a. Dollars in the United States up from three trillion US.

Waiver of Specified Premium. Term life insurance is a life insurance policy that covers the policyholder for a specific term or amount of time. The face value or face amount of a life insurance policy is established when the policy is issued.

The maximum face amount of a USGLI policy is 10000. To provide life insurance protection for other than dishonorably discharged Veterans who are service-disabled separated from active duty on or after April 25 1951 and to provide mortgage protection life insurance for Veterans and Servicemembers who have received. Term life insurance is one of the most affordable types of life insurance.

You choose the life insurance face amount when you buy a policy and the amount is stated in your contract. S-DVI is issued in amounts up to 10000. Face Decrease Monthaversary.

Provide supplemental income in 35 years. Policies were issued in a variety of permanent plans and as renewable term insurance. Waiver of Specified Premium.

The written notification must include a disclosure of the face amount of life insurance either in dollars or as a multiple of salary that the policyholder reasonably expects to purchase with. Currently there are over 280 million life insurance policies in force across the US. The gross premium G for a fully discrete whole life insurance with face amount of 1000 issued to 40 is determined using the equivalence principle.

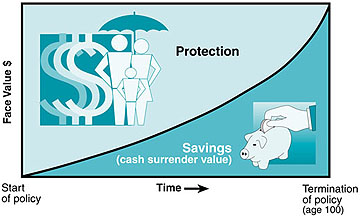

Increases the policys face amount d. Supplemental S-DVI is issued in amounts up to 30000. As with whole life policies option b pays the cash value plus the face value after the death of the insured.

In 2017 that number grew to about 163000. The policyholder determines the term of the life insurance policy which typically ranges from 10 to 30 years and can increase in 5-year increments. Intends to insure the employees life and the maximum face amount for which the employee could be insured at the time the contract was issued.

The face value of a life insurance policy is the death benefit while its cash value is the amount that would be paid if the policyholder opts. 2 hours agoThe face value is the amount of money your insurer has agreed to pay out when you die. Dollars in the previous year.

For some of these policies you could end up paying more in premiums than your beneficiaries will receive upon your death. This number can be found in the policys schedule of benefits. Life Insurance for Veterans - Face Amount of New Life Insurance Policies Issued.

Prior to October 1 2008 the maximum amount of credit life insurance could not exceed 50000 with any one creditor.

No Exam Life Insurance Pros And Cons Cnn Underscored

/they-ve-agreed-to-the-deal-1040246654-7088bece106a496588aabdac14009f85.jpg)

A Look At Single Premium Life Insurance

/GettyImages-1053743626-3b1327252ce94a998c9508c06fed8eea.jpg)

How To Easily Understand Your Insurance Contract

Guaranteed Issue Life Insurance Policies Fidelity Life

How Does Life Insurance Work The Process Overview

Key Factors Nris Should Consider Before Buying A Life Insurance Policy

Guaranteed Issue Life Insurance Policies Fidelity Life

Life Insurance Purposes And Basic Policies Mu Extension

Life Insurance Over 70 How To Find The Right Coverage

/life_insurance_151909996-5bfc371046e0fb005147a943.jpg)

How Cash Value Builds In A Life Insurance Policy

What Is Life Insurance Everything You Need To Know Policyme

How Whole Life Insurance Works Permanent Life Insurance Whole Life Insurance Life Insurance Policy

In Force Life Insurance Explained Trusted Choice

Best Life Insurance For Seniors

Life Insurance Purposes And Basic Policies Mu Extension

Is Life Insurance Taxable In Canada Moneysense

Glossary Of Life Insurance Terms Smartasset Com

Credit Life Insurance Explained Policy Advice

What Does It Mean When A Life Insurance Policy Is Paid Up Life Ant